“Construction businesses in EMEA are in a unique position. Technology adoption continues to rise – spurred by rapid advances in artificial intelligence and excitement about its potential in the built environment.

But at the same time, firms are still grappling with decades-long challenges: economic uncertainty, skills shortages and inefficient ways of working.

To follow how these developments are unfolding, each year Autodesk’s State of Design and Make report captures the views of global business leaders – including their perspective on technology.

In this report, we’ll explore trends in EMEA with new data on 14 countries, including the unique challenges and opportunities in each market.

We’ll compare digital leaders with those starting on their journey – to see how technology is driving success in our region.”

Matthew Keen, Director, Construction Strategy, Autodesk

For the purposes of this report, digital leaders are considered as companies that have fully automated their workflows and are actively integrating AI. Emerging companies are still undergoing digital transformation but have cloud based systems in place to manage workflows. Beginner companies are heavily reliant on manual processes and have not fully integrated any digital tools.

France; Germany; Ireland; Italy; the Middle East: Saudi Arabia and the UAE; the Netherlands; Nordics: Denmark, Finland, Norway, Sweden; Spain and Portugal and the UK.

Globally, instability and rising costs are common challenges for construction, with leaders pointing to economic uncertainty (55%), higher labour costs (55%) and the cost of raw materials (55%) as their most common concerns.

There are differences between countries – and economic uncertainty is particularly troubling for leaders in Spain and Portugal (66%), and France (61%).

Business leaders are also grappling with other issues. Globally 54% of companies say their project backlog has grown, with 35% saying it has stayed the same. It is a disappointment to find that a culture of late payments persists with 89% of respondents reporting this across all projects, rising to 97% in Ireland.

Despite these challenges, most construction leaders are optimistic about the future. Globally, 65% feel positive about the financial performance of their business over the next three years, and 62% feel positive about the future of the construction industry overall.

Amongst European countries, Irish and Dutch leaders are the most positive about their businesses’ prospects (77% and 70% respectively) – and German leaders are the least (43%).

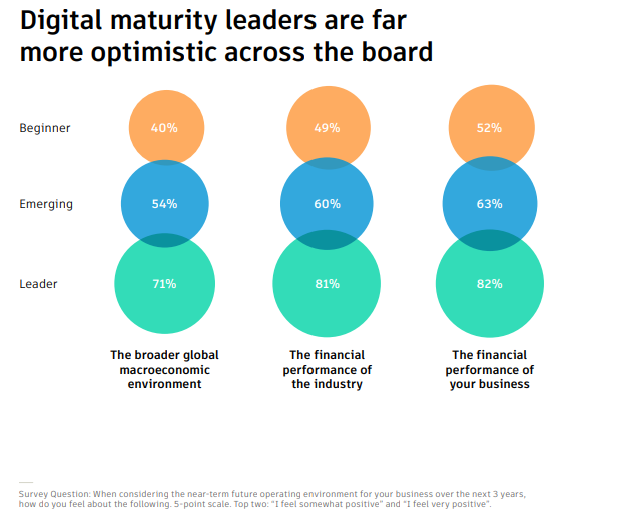

Digital maturity has a significant influence on leaders’ levels of optimism. Construction companies that have prioritised digital transformation tend to be more optimistic; 82% of digital leader organisations feel positive about the financial performance of their business, compared to emerging (63%) or beginning (52%) organisations.

Digital maturity continues to vary significantly between construction businesses, as shown by the range of digital tools used. Globally, spreadsheets are the most popular digital tool used on projects (35%) – and are still used by 41% of firms in Ireland.

Project management software (29%), 2D and 3D modelling tools (28%) and BIM software (28%) are also popular, with Middle East (Saudi Arabia and UAE) slightly ahead in BIM adoption (38%).

Local regulations could play a role in some cases, with firms in the Netherlands nearly twice as likely to be using a CDE on projects (33%) following a series of digital requirements introduced by public bodies, including the recent Dutch Environmental Database (NMD).

Data management remains a challenge. Only 38% of construction leaders rate their company’s ability to share data as strong, rising to 49% in the UK; however, the majority say their data sharing abilities are just acceptable.

An average of thirteen hours per week is spent looking for data by each employee. However, this is less of an issue within firms that have prioritised digital transformation. Digital leaders spend two hours less per week on the same task, resulting in 5% more time for them to focus on higher-value work.

The quality of data available is a further concern. Almost one in two leaders globally (50%) worry about having accurate, structured data from which they can make business decisions, rising to nearly two thirds in Spain and Portugal (65%).

As public and private sector clients become more prescriptive with their data handover obligations, and legislative requirements grow, providing quality structured data will no longer be optional, but an obligation. For example, the recent EU Construction Product Regulation with digital product passports is setting new requirements that firms will need to meet – making robust data management essential.

The pace of technological change is intimidating for some businesses, with 50% of leaders concerned about investing in a technology that quickly becomes obsolete. But more digitally mature businesses also tend to be more confident about the latest technology.

Digital leaders are more likely to say they are adopting AI workflows in the next few years. For example, 41% will incorporate AI into their field collaboration workflows in the next 1-2 years, compared to 31% of beginner and emerging organisations.

Construction leaders are noticeably less enthusiastic about AI than they were 12 months ago, with trust in the technology dropping 14 points year-on-year according to Autodesk’s 2025 State of Design & Make report. And while 68% believe AI will enhance the construction industry, this is down sharply from 80% in 2024.

Knowledge may play a key role here, as 47% of leaders are concerned about understanding where AI can help in their business, according to the data from this research.

Construction has long had a people problem, and globally one in two firms are concerned about a lack of workers with suitable skills (53%). This challenge is especially prominent in Spain and Portugal (64%) and the Middle East (64%) – compared to just 39% in the Nordics.

The maturing workforce is contributing to this people shortage. While 63% of firms globally say the ageing workforce is a significant challenge, this rises to 79% of leaders in Ireland and 72% in France.

This skills shortage is having a financial impact. Today, 55% of construction leaders say that lack of access to skilled talent is a barrier to their company’s growth, up from 40% in 2024, according to the 2025 State of Design & Make report.

Positively, many companies are taking action to promote careers in the construction industry to a wider demographic.

Two thirds of leaders globally say their company is taking measures to attract young talent (65%), rising to 80% in Ireland and 73% in the Middle East.

Likewise, both countries are working to attract diverse talent: 78% of Irish firms and 68% of Middle Eastern firms have measures in place, compared to 64% of businesses globally.

Sustainability measures may also be important for employer brands. Two thirds of leaders report their sustainability efforts help attract and retain talent (66%), according to the 2025 State of Design & Make report.

However, cultural change may still be needed to ensure that construction is established as an attractive industry for a wide range of candidates. Only two thirds of leaders worldwide would recommend a career in construction to their friend or family member (65%). In Germany, 29% of leaders actively would not.

Germany | The view from Autodesk: “Whilst the general consensus amongst German construction firms may be that the future is uncertain, the opportunities in our industry remain exciting. I believe in the possibilities of working in a creative, impactful industry that provides skills from problem-solving and collaboration to data strategy and AI expertise. As digital tools continue to be adopted, construction will become more attractive and accessible to a broad range of talent – and it is important that we show these candidates the potential of careers in our industry. I am excited to see what construction professionals can achieve over the next decade and beyond.” Daniela Becker, Vice President EMEA Global Named Accounts at Autodesk

The Nordics | The view from Autodesk: “The optimism among Nordic construction firms likely reflects the cushioning effect of ongoing infrastructure investments, particularly in Sweden and Norway, which help balance the slowdown in residential construction. However, the relatively low concern about skilled labour shortages in the survey doesn’t fully align with what we observe in the market. While the issue may feel less acute due to current project types or temporary workforce availability, there are persistent gaps in specialised roles – especially in digital construction and project management – that could become more visible as demand shifts. On digitalisation, the region is mature in awareness but still evolving in execution. Many firms know what needs to be done, but progress is slow, and the fact that employees still spend nearly 16 hours a week searching for data underscores the need to accelerate practical implementation of digital strategies.” Pontus Bengtson, Business Development Executive at Autodesk

The UK | The view from Autodesk: “UK construction firms have long grappled with uncertainty, from the impact of Brexit to regulatory change and now shifting trading arrangements. Positively, many firms have been adopting digital tools, with the national BIM programme a principal driver that led to the global ISO 19650 series of standards, as well as response to regulations like the Building Safety Act. These businesses may now be feeling the benefits of better data to inform decision-making and improve collaboration. Going forward, the growing awareness and availability of these kinds of tools will be crucial for attracting the young and diverse talent that construction still so urgently needs.” Marek Suchocki, Head of Industry Associations Strategy at Autodesk

Construction firms in EMEA continue to grapple with uncertainty about the future of the industry. Long-standing issues like people shortages, late payments and project backlogs still present headaches – and may compromise businesses’ resilience in the face of change.

But positively, there are clear indications that technology adoption gives businesses an edge, even in the face of significant challenges. More digitally mature firms win more work, with leaders 19% more likely than emerging and 37% more likely than beginner companies to have a win rate above 60%.

A strong digital strategy can help businesses to improve productivity – and profitability – and attract the talent desperately needed. Importantly, digital maturity also helps leaders to be more confident when it comes to emerging technologies, preparing companies to quickly and successfully seize the opportunities that AI presents.

Learn more about how to grow your business’ digital maturity here.

View the global State of Design and Make Construction Spotlight report here.

The research was conducted by Censuswide, with 3,503 construction professionals (150 respondents in Ireland, UK, Netherlands, France, Germany, India, Japan, Australia, Canada, Sweden, China and South Korea. 100 respondents in Singapore, New Zealand, Denmark, Finland, Norway, Italy, Spain, Mexico, Brazil, Portugal, UAE and Saudi Arabia. 400 respondents in the US and 50 in Malaysia and Indonesia) between 21.02.25 - 11.03.25. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles.

The Autodesk State of Design and Make report surveyed and interviewed 5,594 industry leaders, futurists, and experts in the architecture, engineering, construction, and operations; product design and manufacturing; and media and entertainment industries from countries around the globe. The quantitative data (n=5,560) was collected between May and August 2024 through a 20-minute online survey. The Construction Services subset used in this report consists of 405 respondents. Autodesk partnered with Qualtrics for the collection of this data. In addition, 34 qualitative interviews with business leaders and futurists were conducted in October and November 2024.