It’s not uncommon in the construction industry for teams to work with subcontractors or materials suppliers from different countries. With the possibility of materials pricing rising, especially in today’s market, this presents risk due to currency exchange rate fluctuations.

Managing the procurement process and properly tracking costs with international suppliers is critical to help mitigate risk. This process isn’t always easy. Currency conversions are often completed manually and it’s not easy to understand the risk at any given time.

With the release of Multi-Currency in Autodesk Build and BIM 360 Cost Management, teams can now easily manage supplier contracts, change orders, payment applications, and expenses in different currencies.

Everything is converted back to the project’s base currency for accurate reporting. Any gains or losses are easily visible and can be used as the basis for forecast adjustments.

So how might this feature impact your teams directly? Imagine you are a USA based General Contractor who purchased material steel from Canada for $55K CAD due to steel shortages in the US. With a 1.1 exchange rate, the approved contract between you and the Canadian based supplier equals $50k USD. With Multi-Currency in Cost Management turned on, in the supplier’s contract you can easily view the schedule of values in both currencies.

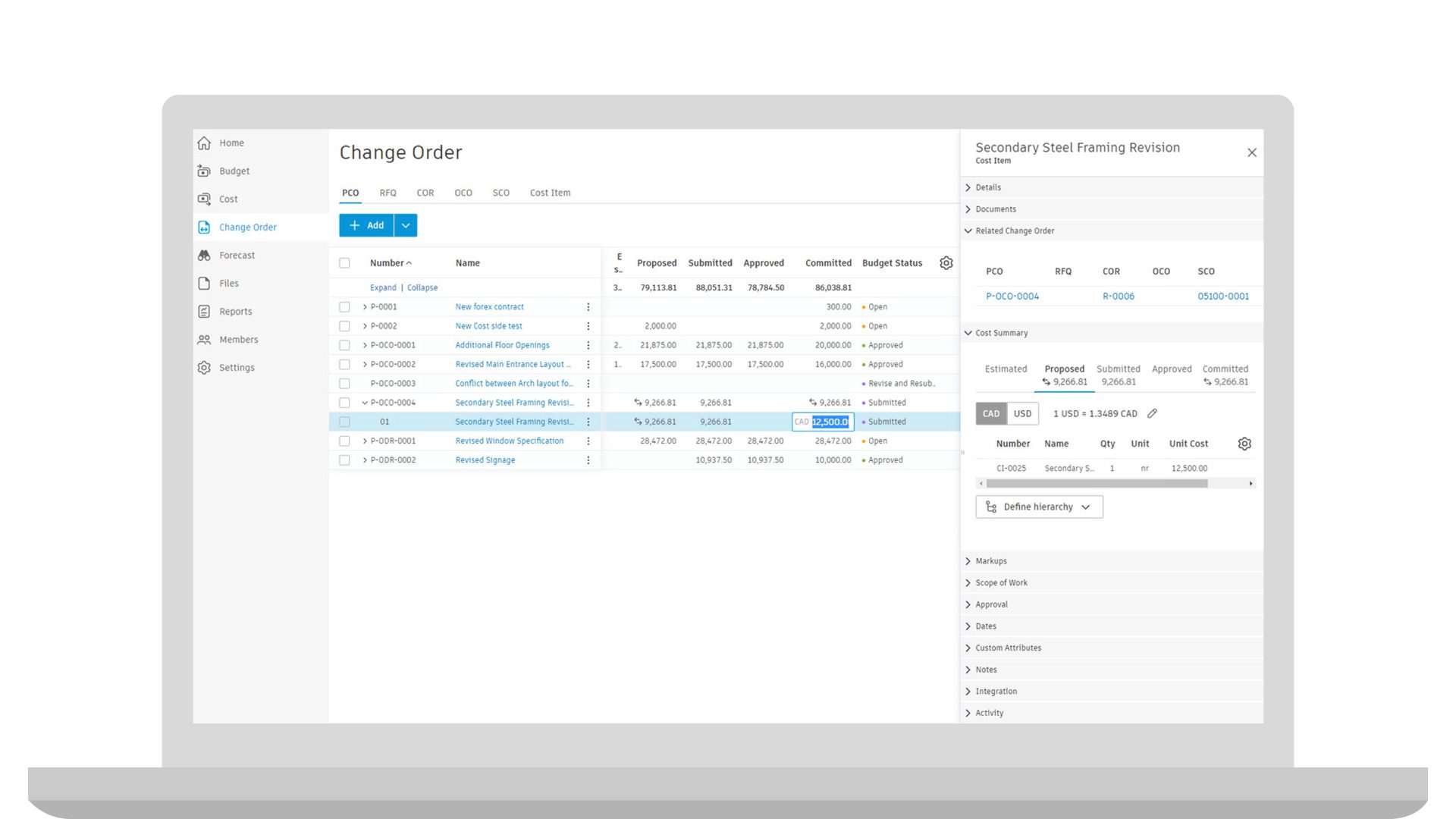

Then, as the project progresses, and you need to send change orders, they can also be entered and managed in the foreign currency.

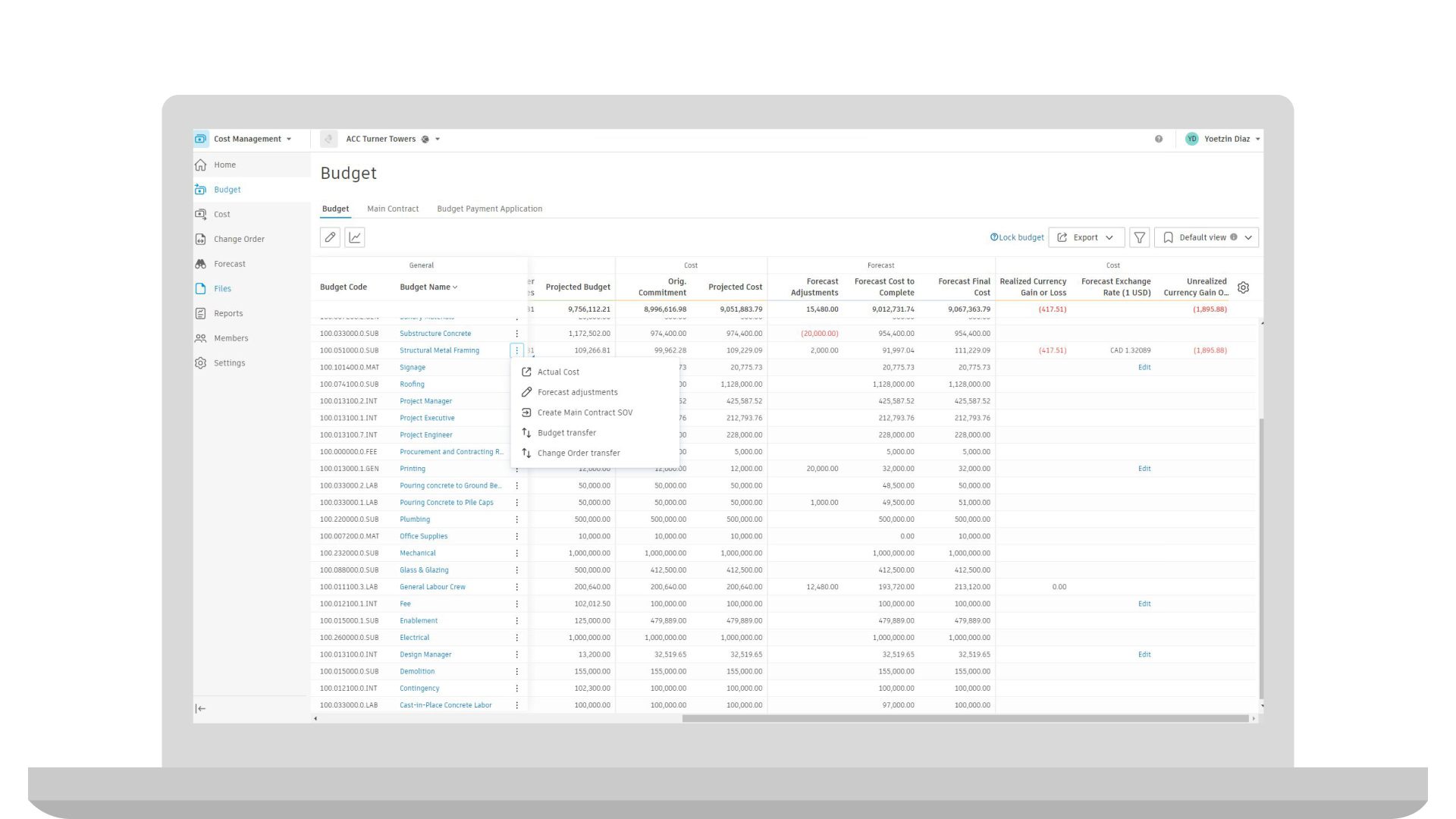

As actual (realized) costs come in (e.g., invoices, pay apps, etc.) the system automatically tracks it in the budget overview and next to it displays a realized gain or loss for that item. By hovering over the column, you can easily view the rate it’s being calculated on and recalculate if needed.

Taking it a step further, you also have insight into projected (unrealized) costs that have not yet been claimed. Being able to quickly see this, you can now forecast the end cost as accurately as possible. Although the currency fluctuation may or may not feel significant, a potential loss of their original contract amount can mean a cost overrun.

Users can then use the realized amount, unrealized amount, or sum of both to generate a forecast adjustment.